Managing your finances efficiently is essential in today’s fast-paced world. The UBA Prepaid Card offers a seamless way to handle transactions, shop online, and travel without the hassle of carrying cash. Whether you’re looking for convenience, security, or budgeting control, this prepaid card is a reliable financial tool.

In this article, you’ll discover everything you need to know about the UBA Prepaid Card, including how it works, its benefits, where you can use it, and how to apply. Keep reading to find out why this card is the perfect choice for your financial needs.

What is the UBA Prepaid Card?

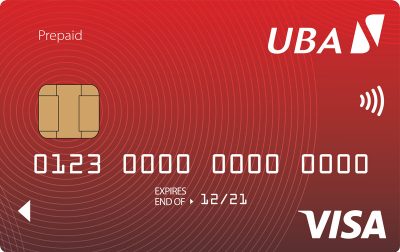

The UBA Prepaid Card is a reloadable payment card issued by United Bank for Africa (UBA). Unlike a traditional credit or debit card, it does not require a bank account. Instead, you load funds onto the card in advance and use it for transactions until the balance is exhausted.

This card is ideal for individuals who prefer cashless payments without the commitment of a bank account. It offers financial independence, allowing users to spend only what they load onto the card, making budgeting and expense tracking easier. Additionally, it eliminates the risk of debt accumulation, as you cannot spend more than your available balance.

How does the UBA Prepaid Card work?

Using the UBA Prepaid Card is simple and straightforward. First, you need to load funds onto the card through a UBA branch, online banking, or an ATM. Once funded, you can use it for various transactions, just like a regular debit card.

Since it is prepaid, there are no overdraft fees or interest charges. You can only spend the amount available on the card, ensuring better financial control. Additionally, you can reload the card whenever necessary, making it a flexible payment solution for everyday expenses, online shopping, and travel needs.

Key benefits of the UBA Prepaid Card

The UBA prepaid card has several advantages that make it a safe, practical and intelligent financial choice to facilitate your purchases and payments. It also has a number of benefits for your day-to-day life. Here are some of the main ones.

List of benefits

- 1. No bank account required: one of the main advantages of the UBA Prepaid Card is that you don’t need a bank account to own or use it. This makes it accessible to a wide range of users, including students, freelancers, and travelers.

- 2. Enhanced security: security is a priority when it comes to financial transactions. The UBA Prepaid Card is equipped with EMV chip technology, which protects against fraud and unauthorized access. Additionally, you can easily block or replace the card if lost or stolen.

- 3. Budgeting and expense control: since you can only spend the amount loaded on the card, it prevents overspending. This feature is particularly useful for people who want to stick to a budget or manage their expenses more effectively.

- 4. Convenient online and in-store payments: the card is widely accepted at millions of merchants worldwide. You can use it for online shopping, paying bills, and making purchases at retail stores without any hassle. Moreover, it works with multiple payment networks.

- 5. ATM withdrawals: need cash? The UBA Prepaid Card allows you to withdraw money from ATMs whenever required, providing instant access to your funds. This feature makes it an ideal backup for emergency situations or when digital payments are not an option.

- 6. Travel-friendly features: this card is an excellent companion for travelers. It can be used internationally, helping you avoid carrying large sums of cash. Plus, it supports multiple currencies, making it ideal for business and leisure trips.

- 7. Easy reload options: adding funds to your card is quick and hassle-free. You can reload it via UBA bank branches, online banking platforms, or ATMs, ensuring you always have access to funds when needed.

Where can you use the UBA Prepaid Card?

The UBA Prepaid Card offers extensive usability, making it a convenient financial tool for various transactions. With such versatile, usability ensures seamless transactions wherever you go, making life more convenient and stress-free. Here’s where you can use it:

- Online shopping: shop securely on e-commerce platforms, pay for subscriptions, and book travel tickets effortlessly;

- In-store purchases: accepted at millions of retail stores worldwide, including supermarkets, restaurants, and shopping malls;

- Bill payments: use it to settle utility bills, internet subscriptions, and other recurring expenses;

- ATM withdrawals: access cash at ATMs anytime, both locally and internationally;

- Travel and hotel bookings: convenient for reserving flights, hotel stays, and car rentals globally;

- Entertainment & dining: pay for movie tickets, concerts, and dining experiences with ease.

How to Apply for a UBA Prepaid Card

Do you like the benefits of the UBA prepaid card and want to get yours? It’s very simple, and the application process can be completed easily in just a few steps. To apply for your card and enjoy the benefits, follow this guide we’ve prepared for you:

- Visit a UBA branch: go to the nearest UBA branch with a valid identification document, such as a passport, national ID, or driver’s license. Some locations may allow online applications, so check with UBA’s official website for availability.

- Fill out the application form: complete the prepaid card application form with accurate personal details to proceed with the registration process. Providing correct information ensures faster approval and minimal delays.

- Make an initial deposit: load your card with an initial deposit. The minimum amount required may vary, so check with your local UBA branch for specific details. Some promotions may even offer fee waivers for first-time users.

- Receive and activate your card: once your application is approved, you will receive your UBA Prepaid Card. Follow the instructions provided to activate it and set up a secure PIN. Activating the card ensures that your funds are protected from unauthorized usage.

- Start using your card: after activation, you can begin using your card for transactions, withdrawals, and online payments right away. Keep track of your balance and reload as needed to continue enjoying the benefits.

Final thoughts: is the card right for you?

The UBA Prepaid Card is an excellent choice for individuals looking for a secure, convenient, and flexible payment solution. With no bank account requirements, enhanced security features, and global usability, it serves as a great alternative to traditional banking methods.

Whether you need a budgeting tool, a travel-friendly card, or a cashless payment solution, this prepaid card offers everything you need. Additionally, its ability to support different financial needs makes it suitable for both personal and business use. Apply today and enjoy the benefits of easy, controlled, and secure financial transactions.