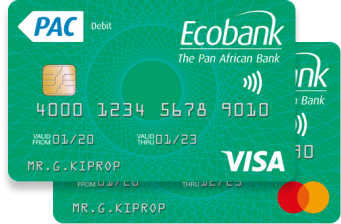

Managing finances efficiently is a cornerstone of modern life, and having a reliable debit card is essential to achieving this goal. The Ecobank Classic Debit Card is specifically designed to provide users with convenient and secure access to their money, meeting the needs of individuals across diverse financial situations.

Whether you’re shopping online, withdrawing cash, or paying bills, the Ecobank Classic Debit Card offers a comprehensive suite of features that cater to everyday banking needs. With a vast network of ATMs and POS terminals, alongside robust security features, this card is a reliable companion for seamless financial transactions.

Key information about the debit card

How does the annual fee work?

One of the most significant advantages of the Ecobank Classic Debit Card is its fee-free structure. Unlike many financial products that come with annual fees or hidden costs, this card allows users to manage their money without the burden of additional expenses. This commitment to transparency and affordability makes it particularly appealing for individuals who want to maximize the value of their banking experience.

How is the credit limit determined?

As a debit card, the Ecobank Classic Debit Card does not involve a pre-set credit limit, distinguishing it from traditional credit cards. Instead, your spending capacity is determined by the available balance in your linked current account. This feature promotes financial responsibility by ensuring that users can only spend what they have, avoiding the risk of debt accumulation.

For prepaid debit cards, the user decides the limit by depositing funds into the account. This flexibility allows individuals to manage their spending according to their financial needs. In contrast, conventional credit cards often rely on factors like income, credit history, and repayment capacity to determine limits. The Ecobank Classic Debit Card, by linking directly to your funds, provides a simpler, more straightforward alternative.

Advantages of the debit card

- Extensive accessibility: With 24-hour access to your funds in over 1,200 branches across 34 countries, you’re never far from your money.

- Large ATM network: Enjoy the convenience of over 2,700 ATMs spread across Africa, ensuring you can withdraw cash whenever needed.

- Cashless convenience: Make purchases at more than 10,000 POS terminals, supporting fast and secure transactions for goods and services.

- Online payment compatibility: The card can be used for e-commerce transactions, allowing users to shop online with ease.

- Currency versatility: Available in local and foreign currencies, it’s ideal for travelers and expatriates managing finances across borders.

- Enhanced security: Features like SMS alerts, monthly e-statements, and advanced fraud detection ensure your money remains protected at all times.

- Integrated banking services: The card comes with access to Ecobank’s online and mobile banking platforms, enabling you to manage your account remotely.

Standout advantage

What truly sets the Ecobank Classic Debit Card apart is its unparalleled reach across the African continent. With a network spanning 34 countries and thousands of ATMs and POS terminals, the card offers unmatched convenience for users conducting transactions within Africa. This makes it an ideal choice for frequent travelers, business professionals, and anyone needing reliable access to funds across multiple regions.

Disadvantages

- Limited international usage: While widely accepted within Africa, the card may not offer the same level of usability outside the continent.

- No credit facility: As a debit card, it does not provide access to borrowed funds, which could be a drawback for those needing emergency credit.

- Potential transaction fees: Some services, such as currency conversion or non-Ecobank ATM withdrawals, may incur additional charges.

- Dependent on account balance: Spending is restricted to the amount available in your linked account, which might not suit everyone’s financial needs.

A standout disadvantage

The main limitation of the Ecobank Classic Debit Card is its reliance on the account balance. Unlike credit cards, which allow users to borrow funds up to a specific limit, this card only permits transactions within the available balance. While this encourages financial discipline, it may pose challenges in situations requiring urgent access to additional funds.

Who can apply for this card?

The Ecobank Classic Debit Card is available to individuals who meet specific eligibility criteria. Applicants must hold a personal or joint current account with Ecobank. Residency within the issuing country is required, and non-residents may need additional documentation, such as notarized proofs of identity and address, to comply with local banking regulations.

Applicants must provide a completed account opening form, recent passport-sized photographs, and valid identification, such as a national ID, driver’s license, or international passport. Proof of address, such as utility bills or tenancy agreements, is also necessary. For salary accounts, an employer’s introduction letter is required, while students may need to provide academic-related identification.

How to apply for the Ecobank Classic Debit Card

For the website

To apply via the website, start by visiting the official Ecobank site and navigating to the “Classic Current Account” page. Here, you’ll find a detailed application form that must be filled out online. Ensure you have scanned copies of the required documents, including proof of identity, proof of address, and any additional materials specified for your country.

Once the form is submitted, you’ll receive a confirmation email with further instructions. The website provides clear guidelines on document submission and offers a user-friendly interface to track the status of your application. This method is ideal for individuals seeking convenience and flexibility, allowing them to apply from the comfort of their home or office.

Through the app

The Ecobank mobile app is another convenient way to apply for the Classic Debit Card. Start by downloading the app from your device’s app store and logging in using your existing account credentials. Navigate to the “Services” section, select “Apply for a Card,” and follow the on-screen prompts to complete the application.

The app also allows you to upload documents directly from your device, making the process quicker and more efficient. Additionally, you can monitor the progress of your application in real-time through the app’s tracking feature. With its intuitive design, the mobile app streamlines the process for tech-savvy users.

At the branch

For those who prefer a personal touch, applying in person at an Ecobank branch is a great option. Bring all required documents, such as identification, proof of address, and recent photographs, to the nearest branch. A customer service representative will assist you in completing the application form and provide detailed explanations of the card’s features and benefits.