Managing your finances efficiently requires reliable tools that provide security and convenience. The Ecobank SalaryXpress Card stands out as a unique solution for individuals seeking seamless access to their salaries without the need to open a bank account.

This card is designed with simplicity and accessibility in mind, catering to diverse needs. Whether you’re looking to eliminate the hassle of handling cash or explore a secure payment method usable worldwide, this card could be the perfect fit for your financial lifestyle.

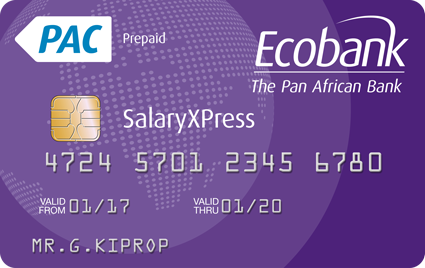

Key information about the credit card

How does the annual fee work?

One of the most appealing aspects of the Ecobank SalaryXpress Card is its no-annual-fee structure. For many users, avoiding annual fees can make a significant difference, ensuring that more of their income stays where it belongs—in their wallet. With no extra charges to maintain the card, users can focus on enjoying the card’s benefits without worrying about hidden costs.

The absence of an annual fee underscores the bank’s commitment to delivering cost-effective financial solutions. This feature makes the card particularly suitable for individuals seeking a hassle-free way to manage their salaries while keeping expenses low.

How is the credit limit determined?

The Ecobank SalaryXpress Card operates as a prepaid card, meaning the credit limit is directly controlled by the user. Unlike traditional credit cards where the bank sets a limit based on factors like creditworthiness or income, this card gives the user full authority over how much money is loaded onto the card.

Employers arrange for the user’s salary to be loaded directly onto the card, and from there, the cardholder can decide how to allocate their funds. This level of flexibility is ideal for those who want complete control over their spending while enjoying the convenience of a card.

Advantages of the credit card

- Worldwide accessibility: The card is accepted at over 1.6 million ATMs and 24 million POS terminals globally, enabling users to withdraw local currency wherever they are.

- No Ecobank account required: Employees don’t need to open an Ecobank account to use this card, simplifying the onboarding process.

- 24/7 convenience: Payments and withdrawals can be made at any time, whether at home or abroad.

- Cashless security: By replacing cash payments, the card reduces the risk of theft or loss.

- User control: Cardholders can set their own spending limits based on their salary and manage funds more effectively.

Standout advantage

The standout feature of the Ecobank SalaryXpress Card is its unparalleled accessibility. Unlike many traditional financial products, it doesn’t require the user to have a bank account. This is particularly beneficial for individuals who may not have access to conventional banking services but still need a reliable way to manage their income. The card bridges a crucial gap, empowering more people to participate in the digital financial ecosystem with ease.

Disadvantages

- Limited to salary deposits: The card’s functionality revolves around receiving salaries, limiting its versatility for other income types.

- Dependence on employer arrangements: Users can only access the card if their employer partners with Ecobank to load salaries onto it.

- No traditional credit benefits: As a prepaid card, it doesn’t build credit history or offer traditional credit perks like rewards or cash back.

A standout disadvantage

The primary limitation of the Ecobank SalaryXpress Card lies in its dependency on employer arrangements. Without an agreement between the employer and Ecobank, individuals cannot access the card or its benefits. This dependency could make the card less appealing for those seeking more independent financial solutions.

Who can apply for this card?

The Ecobank SalaryXpress Card is specifically designed for employees who receive their salaries through an employer partnered with Ecobank, offering convenience and flexibility. Unlike traditional cards, applicants are not required to open an Ecobank account, simplifying the onboarding process. Eligibility hinges on basic criteria, including formal employment and an employer willing to participate in the SalaryXpress program.

As a prepaid card, it eliminates the need for credit checks or extensive income verification, relying instead on standard employer documentation. However, it is not accessible to individuals without formal employment or those receiving income through non-salary channels, making it a focused solution for salaried employees seeking an easy-to-use financial tool.

How to apply for the Ecobank SalaryXpress Card

Applying for the Ecobank SalaryXpress Card is straightforward and can be done through various channels. Whether you prefer to apply online, through a mobile app, or in person, Ecobank offers multiple options to ensure a smooth process.

For the website

To apply via the Ecobank website, start by visiting their official platform and navigating to the SalaryXpress Card section. Here, you’ll find detailed information about the card and its features. Once ready, proceed to fill out the online application form. This form typically requires basic details such as your name, contact information, and employer details.

Your employer will also need to initiate the process by contacting Ecobank to arrange the salary loading mechanism. Once the setup is complete, you’ll receive your card, ready for use. Online applications are especially convenient for individuals who want to start the process without visiting a branch.

Through the app

Ecobank’s mobile app offers another efficient way to apply for the SalaryXpress Card. Simply download the app from your device’s app store and log in or register. Navigate to the card services section and select the SalaryXpress Card option.

Follow the prompts to complete your application. The app allows you to upload required documents and track your application status in real-time. Using the app is ideal for tech-savvy users who prefer handling their financial needs digitally.

At the branch

For those who prefer a face-to-face approach, applying at an Ecobank branch is a reliable option. Visit the nearest branch with your identification documents and any employer-provided paperwork. Speak to a customer service representative who will guide you through the application process.

In-person applications are particularly useful for individuals who may have questions or require additional support during the process. Branch visits also provide the opportunity to learn about other Ecobank services that might complement the SalaryXpress Card.