Due to the ever-changing market in the financial sector, the gold card account by the Discovery Bank is a complete one-stop banking solution that goes beyond just having a credit card. If flexibility, reasonable price, and a number of rewards are on the seeker’s list, this account may tempt him/her to choose it.

That is why, if you are striving to get the most out of your financial operations while being provided with numerous benefits, the Discovery Bank Gold Card Account may suit you. It is now time to look at what specifics of this card makes it a proposition that can and should be unique in the market.

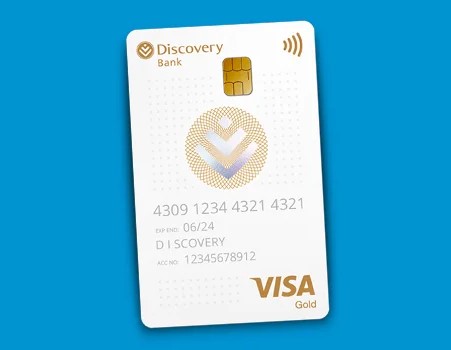

Key information about the credit card

How does the annual fee work?

The Discovery Bank Gold Card Account attract reasonable monthly fee charges of R100. This fee covers the monthly account maintenance fee, your extra Vitality Money premium and single credit facility fee – thus a flexible single easy to pay fee.

How is the credit limit determined?

The buffer for the Discovery Bank Gold Card Account is approved according to the client’s annual income and the credit score. The credit limit for individuals earning between R100,000 and R350,000 per year is personalized to avoid granted credit scores that you can barely manage to pay back.

Advantages of the credit card

- Flexible credit facility: Some of your transactions can have up to 55 days of interest for convenient credit control.

- Real-time Forex Accounts: Replace 5 everyday words with phrases relevant to banking and available on the banking app for easy international banking.

- Vitality Money rewards: Get Discovery Miles for exercising, eating right, spending wisely and safe driving.

- Discounts on travel: Travel has been made Affordable by getting up to 40% Discount on Flights, Hotels and Car Hire deals for the Local and International.

- Dynamic Interest Rates: Enjoy lower interest rates that are attached to your specific Vitality Money level.

Standout advantage

Perhaps, the most striking thing about the Discovery Bank Gold Card Account is its connection with the Vitality Money plan. Besides quidditch, this program encourages you to live healthily and financially wisely, as well as provide you with a smart shared-value stack of preferable lifestyle & travel rewards.

Disadvantages

- Monthly fee: The card attracts a fee of one hundred Rand per month, this might be off-putting for some people.

- No fee waiver: In regards to the monthly fee there are no options for spending or balance to try to waive the fee.

- Interest rates: Nevertheless, the interest rates are rather low and, at the same time, can be relatively high for customers with lower Vitality Money status.

A standout disadvantage

The main disadvantage of the Discovery Bank Gold Card Account is that there is no provision for the discharge of the annual fees. As noticed in the case with other cards, there are some options when the monthly fee can be avoided depending on the amount of spending or the balance at the account; this card has a steady monthly fee.

Who can apply for this card?

Before applying for the Discovery Bank Gold Card Account you need to meet some requirements. The applicants should be of more than 18 years of age and earn an income of more than R 100 000 per annum.

Other criteria include good credit history enjoyed by the holder of this card as it is not applicable for people with adverse credit history. Also, an applicant is required to attach his/her proof of income and a valid South African identity document.

How to apply for the Discovery Bank Gold Card Account

For the website

To fill in the application for the Discovery Bank Gold Card Account submission, it is necessary to visit the official website of the bank, and in the corresponding tab, fill in the application for the Gold Card Account.

Here, there is an application form where you are expected to enter your personal information like your name, address, and more. You will also be required to fill in your employment information, and income documents that can be uploaded on the site.

Once all the documents have been uploaded, then your application will be reviewed and you will receive the results through your email. The online application process is simple and takes only a few minutes to complete and does not in any way present any inconvenience in the issuance of the card.

Through the app

Another simple way is through the Discovery Bank app to apply. For the first step, open the app store of your mobile phone and install the Discovery Bank app if it is not installed already for this purpose, and if it is already installed, then you just have to open it and if you are a new user you would have to create an account with it.

After successfully logging in, go to the “Apply for a Card” tab. This way when using the App, the user will be taken through each step when applying for a job. The requirements for the in-person session are identical to those of the online application ~ they will ask the applicant for personal data, employment history, and proof of income.

This makes it possible for one to capture pictures of the documents using the app and upload them. This method is especially considered extremely suitable for individuals who decide to conduct their banking operations on the go since it allows applying for the Discovery Bank Gold Card Account effectively and promptly.

At the branch

Third, you have the option to open the Discovery Bank Gold Card Account online, or in personal manners at a store with Discovery Bank. Go to the Discovery Bank center nearest to you and consult a banking consultant. The consultant will issue an application form that has to be filled in as well as explain what steps have to be taken.

One has to present a South African ID, proof of income and or any other documents which may be needed. In this case, the consultant will confirm all the information you have provided, make your application and then notify you of the next processes.

Regardless, this in-person application method makes it possible for you to ask questions and receive an on the spot response; a plus for those who like to deal with their issues through face to face meeting.