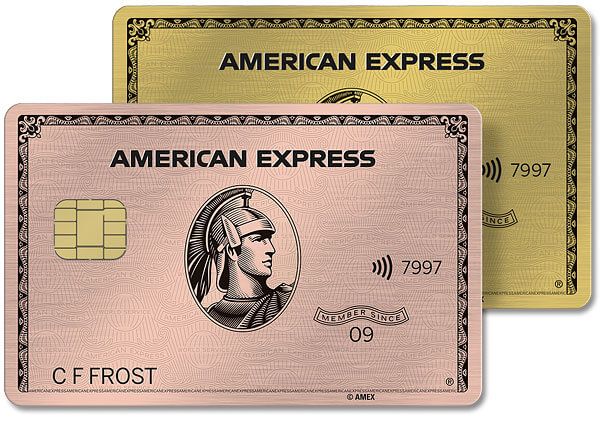

The American Express Gold Card is a premier credit card designed for individuals who value luxurious perks, exceptional rewards, and unmatched flexibility in managing their finances. With benefits tailored for dining, travel, and everyday purchases, this card is ideal for those who want to maximize their spending potential while enjoying exclusive privileges

Whether you’re dining at your favorite restaurant, booking a flight, or shopping for groceries, the American Express Gold Card offers impressive rewards and a host of features that set it apart from other cards.

Key Information about the American Express Gold Card

The American Express® Gold Card comes with a host of benefits tailored for consumers who enjoy dining out and traveling. From earning substantial rewards points on various spending categories to enjoying exclusive travel perks, this card offers a versatile and rewarding experience. Here’s a closer look at what the American Express® Gold Card offers.

How Does the Annual Fee Work?

The American Express® Gold Card comes with an annual fee of $250. While this may seem high compared to some other cards, the extensive benefits and rewards can easily offset the cost for many users.

The fee is billed once a year and cannot be split into monthly payments. However, the value received from the card’s rewards and credits often exceeds the annual fee for cardholders who take full advantage of its perks.

How is the Credit Limit Determined?

The credit limit for the American Express® Gold Card is determined based on several factors, including the applicant’s creditworthiness, income, and overall financial profile.

Unlike some traditional credit cards that offer a fixed limit, the American Express Gold Card provides a flexible spending limit that can adjust based on the cardholder’s payment history and spending patterns. This feature offers added flexibility, allowing users to make larger purchases without being constrained by a predefined limit.

Advantages of the American Express Gold Card

- 4X Points at Restaurants: Earn four times the Membership Rewards® points at restaurants worldwide, including takeout and delivery in the U.S.

- 4X Points on Groceries: Earn four times the points at U.S. supermarkets on up to $25,000 in purchases per year.

- 3X Points on Flights: Earn triple points on flights booked directly with airlines or through amextravel.com.

- 1X Points on Other Purchases: Earn one point per dollar spent on all other eligible purchases.

- $120 Dining Credit: Enroll and earn up to $10 in statement credits monthly when using the Gold Card at participating dining partners.

- $120 Uber Cash: Add your Gold Card to your Uber account and receive $10 in Uber Cash each month.

- No Foreign Transaction Fees: Enjoy no additional fees on purchases made abroad.

- The Hotel Collection: Get a $100 experience credit with a two-night minimum stay when booking through American Express Travel.

- American Express Preferred Access: Access premium seats for select cultural and sporting events.

Highlighted Benefit: Membership Rewards Points

One of the standout features of the American Express® Gold Card is its robust Membership Rewards® Points program. Cardholders can earn significant rewards through everyday spending, particularly on dining and groceries.

The points can be redeemed for a wide array of options, including travel, gift cards, and statement credits. This flexibility and the high earning potential make the Membership Rewards® Points program a major advantage for users who want to maximize the value of their spending.

Disadvantages of the American Express Gold Card

- High Annual Fee: The $250 annual fee may be a deterrent for some users.

- Limited Supermarket Rewards Cap: The 4X points on groceries are limited to $25,000 in purchases per year.

- Not Widely Accepted Internationally: While there are no foreign transaction fees, American Express is not as widely accepted as Visa or MasterCard in some international locations.

Highlighted Disadvantage: High Annual Fee

The primary drawback of the American Express® Gold Card is its high annual fee. At $250 per year, it is more expensive than many other cards on the market. However, for those who can fully utilize the card’s benefits, such as the dining credits and rewards points, the fee can be justified by the value received.

Who Can Apply for the American Express Gold Card?

To apply for the American Express® Gold Card, applicants must meet the following criteria:

- Age Requirement: Applicants must be at least 18 years old.

- Income Requirement: While there is no specific income threshold disclosed, a higher income can improve approval chances.

- Credit Score: A good to excellent credit score is recommended for approval.

- Residency: Applicants must be U.S. residents with a valid Social Security Number or Individual Taxpayer Identification Number.

- Credit History: A solid credit history with timely payments can increase approval odds.

How to Apply for the American Express® Gold Card

Applying for the American Express® Gold Card is a straightforward process that can be completed online, via the mobile app, or at a physical location.

Online

- Visit the American Express Website: Go to the official American Express website and navigate to the Gold Card page.

- Fill Out the Application: Provide personal information, including your name, address, income, and Social Security Number.

- Submit the Application: Review your information and submit the application. You will receive a decision in minutes.

Applying via the Mobile App

- Download the Amex App: Available on both iOS and Android platforms.

- Log In or Create an Account: Enter your details or create a new account if you’re a first-time user.

- Navigate to the Gold Card Application: Follow the prompts to apply for the Gold Card.

- Submit the Application: Provide the necessary information and submit your application.

In-Store or at an Agency

- Locate a Participating Store or Agency: Visit a location that partners with American Express.

- Speak with a Representative: Discuss your application with an agent, who will guide you through the process.

- Submit Required Documents: Provide any necessary documentation, such as proof of income and identification.

- Complete the Application: Fill out and submit the application with the assistance of the representative.

By understanding the key features, benefits, and application process of the American Express® Gold Card, prospective cardholders can make an informed decision about whether this prestigious card aligns with their financial goals and lifestyle.