In today’s fast-paced world, achieving your personal goals often requires immediate financial support. WesBank CashPower Personal Loans offer a reliable solution to power your passions with ease. These unsecured loans provide quick access to funds with fixed repayments, allowing you to focus on what truly matters.

With convenient terms and straightforward application requirements, CashPower Personal Loans are designed to meet your financial needs. Whether you’re looking to consolidate debt, finance an important purchase, or cover unexpected expenses, CashPower Personal Loans provide the flexibility and support you need.

In this article, we will explore the key features, advantages, disadvantages, and application process for WesBank’s CashPower Personal Loans, ensuring you have all the information you need to make an informed decision.

Key information about the personal loan WesBank

WesBank’s CashPower Personal Loans offer unsecured loans, meaning that no collateral is required to secure the loan. This feature provides significant peace of mind for borrowers who may not have valuable assets to use as security for a loan. Here are the primary details of the CashPower Personal Loans:

- Loan Amount: Minimum R5,000, offering flexibility for smaller personal expenses.

- Repayment Terms: Choose from 24 to 72 months, allowing manageable monthly payments based on financial situation.

- Interest Rates: The interest rates are variable, ranging from 19.25% to 29.25% per annum. These rates are compounded monthly, which means interest is calculated on the outstanding loan balance each month, leading to a more accurate reflection of the cost of borrowing over time.

- Monthly Service Fee: A monthly service fee of R69.00 is applicable throughout the loan period. This fee covers the administrative costs associated with maintaining the loan account.

- Initiation Fee: There is a once-off initiation fee that is applied based on the loan amount. This fee is a standard part of setting up the loan and covers the initial processing and administrative costs.

For example, if a borrower takes out a loan of R60,000.00 at an interest rate of 24.50% per annum over a repayment period of 72 months, the total cost of the loan would include the interest accrued over the term, the initiation fee, and the monthly service fees.

Specifically, with an initiation fee of R1,207.50 and a monthly service fee of R69.00, the total repayment amount would be R137,754.32. This amount results in a fixed Annual Percentage Rate (APR) of 32.76%, which gives a clear indication of the yearly cost of the loan, including all fees and interest.

Advantages of the personal Loan WesBank

Choosing WesBank’s CashPower Personal Loans comes with several benefits designed to make borrowing simple and effective. Here are some key advantages:

- Unsecured Loan: No need for collateral, making it accessible for more applicants.

- Fixed Repayments: Predictable monthly payments help with budgeting.

- Flexible Terms: Loan terms range from 24 to 72 months, providing repayment flexibility.

- Quick Access to Funds: Immediate loan disbursement once approved.

- Transparent Fees: Clear information about service fees and interest rates.

Vantage point: immediate access to unsecured Loans

One of the most compelling reasons to choose a WesBank CashPower Personal Loan is the immediate access to unsecured funds. Unlike secured loans, you don’t need to provide collateral, which speeds up the approval process and allows you to address your financial needs promptly. This is particularly beneficial for those facing urgent financial situations or looking to consolidate debt without the risk of losing valuable assets.

Disadvantages

While WesBank CashPower Personal Loans offer many benefits, it’s important to consider potential drawbacks:

- Higher Interest Rates: Depending on your financial profile, interest rates can be on the higher side.

- Service and Initiation Fees: Monthly service fees and a once-off initiation fee can add to the overall loan cost.

- Credit Criteria: Approval is subject to qualifying criteria, which may exclude some applicants.

Main drawback: higher interest rates

The primary disadvantage of the CashPower Personal Loans is the potential for higher interest rates. With rates ranging from 19.25% to 29.25% per annum, the cost of borrowing can be significant, particularly for those with lower credit scores. It’s crucial to evaluate whether the benefits outweigh the costs based on your financial situation.

Who can apply for this loan?

To apply for a WesBank CashPower Personal Loan, applicants must meet the following requirements:

- Minimum Monthly Income: R5,000.00

- Documentation: Up to 3 months of recent bank-generated PDF statements or payslips, a clear copy of your ID document, and proof of address

- Marital Consent: If married in community of property or under customary/foreign law, consent from your spouse is required

Additionally, the loan is subject to credit checks and qualifying criteria, ensuring that applicants have a suitable financial profile.

How to apply for a WesBank CashPower Personal Loan

Applying for a WesBank CashPower Personal Loan is straightforward and can be done through multiple channels, ensuring convenience for all applicants. Here’s a detailed guide on how to apply:

Via the website

- Visit the WesBank Website: Go to the official WesBank website.

- Navigate to CashPower Personal Loans: Find the CashPower Personal Loans section under “Specialised Finance.”

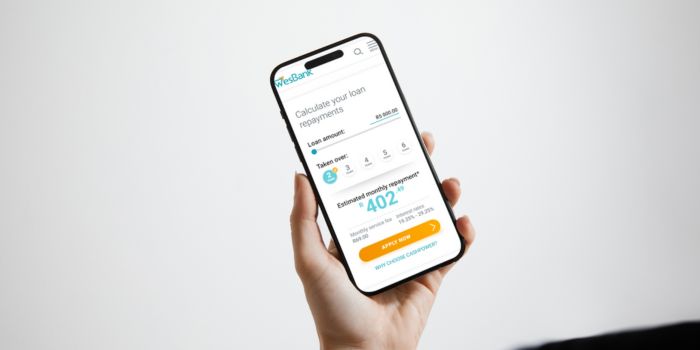

- Calculate Your Loan: Use the loan calculator to determine your estimated monthly repayment based on the desired loan amount.

- Start the Application: Click on “Apply Now” and fill in the required personal and financial details.

- Submit Documentation: Upload your bank statements, ID copy, and proof of address as specified.

- Review and Submit: Ensure all information is accurate and submit your application for review.

Via the mobile app

- Download the WesBank App: Available on both iOS and Android platforms.

- Register or Log In: Use your ID number or passport number (for foreign nationals) to register or log in.

- Access Personal Loans: Navigate to the loans section and select CashPower Personal Loans.

- Complete the Application: Enter your loan details and upload the necessary documents.

- Submit for Approval: Review your application and submit it for processing.

In-store or agency application

- Visit a WesBank Branch: Locate your nearest WesBank branch.

- Consult with a Representative: Speak with a financial advisor to discuss your loan needs.

- Provide Necessary Documents: Bring your bank statements, ID, and proof of address.

- Complete the Application Form: Fill out the loan application form with the help of a representative.

- Submit for Processing: The representative will submit your application for approval.